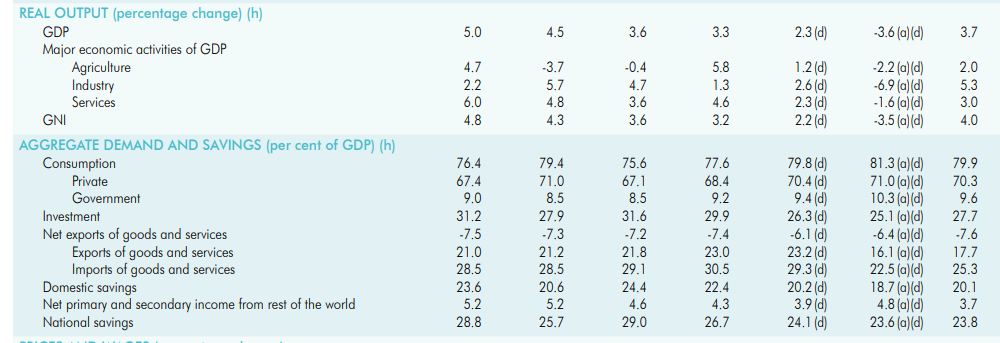

According to the latest Central Bank annual report, Sri Lankan Economy recorded a growth of 3.7 percent in 2021. In 2020 Sri Lanka recorded negative -3.6% economic growth, the deepest recession since the independence. Meanwhile, the International Monetary Fund IMF is forecasting Sri Lanka’s economy to grow by 2.6% in 2022.

Sri Lankan economy recovered in 2021 from the pandemic induced contraction in 2020, albeit with several deeply entrenched structural problems and vulnerabilities inherited over several decades coming to the forefront, thereby resulting in unprecedented socio-political tensions in early 2022. The economy was already in a fragile state lacking the necessary buffers to withstand shocks, when it was hit by the COVID-19 pandemic and other multifaceted headwinds that emanated from the global and domestic fronts. Such vulnerability of the economy can be mainly attributed to the lack of fiscal space, which was further constrained by the changes introduced to the tax structure in late 2019.

Sri Lanka was not an exception in the world in deploying countermeasures to face the pandemic and safeguard the economy to forestall a lasting economic fallout and scarring effects on livelihoods. However, given particular vulnerabilities in the economy, the Central Bank had to be heavily involved in shielding the economy through extraordinary responses, in the form of monetary policy easing, ample liquidity provision to the markets and the Government, and adopting several external sector and financial sector policies, in the absence of adequate policy space in the fiscal sector or an adequately prompt response from the fiscal sector. The ultra easy macroeconomic policy package unveiled by the Central Bank and the Government helped the economic recovery in 2021 from the historical contraction recorded in 2020, while also helping cushion the impact of the pandemic on a broader segment of the stakeholders.

Both public and private sectors enjoyed the comfort of low cost funds for working capital and investment that helped them stay afloat during this difficult time, and keep industries viable, even witnessing some growth, which in turn ensured uninterrupted provision of public services, utilities and goods and services to the public as well as other essential supply chains. However, unprecedented policy responses taken during the peak of the pandemic together with the inability to withdraw the policy measures due to expected fiscal responses not coming through adequately, caused a limited space for reversal measures and led to some unintended effects on macroeconomic stability in 2021, which were further aggravated in early 2022.

Further, the pressures witnessed on the exchange rate amidst dried up liquidity in the domestic foreign exchange market were amplified in 2021 and early 2022, warranting a measured adjustment that was allowed in the exchange rate in early March 2022, compared to the level that prevailed in the market amidst concerns about the adverse impact of any large depreciation of the exchange rate on the society. However, the outcome of the exchange rate flexibility that was thereafter allowed also in early March 2022, fell short of expectations due to the large overshooting by market forces, reflecting the significant liquidity pressures that prevailed in the domestic foreign exchange market as well as the delay in market correction.