Through the 2024 Budget proposals, the government has decided to allocate Rs. 450 billion to recapitalize the state banks in order to secure stability and provide security as the government is in the process of restructuring the local debt accumulated by the state-owned enterprises, Treasury Secretary Mahinda Siriwardana said.

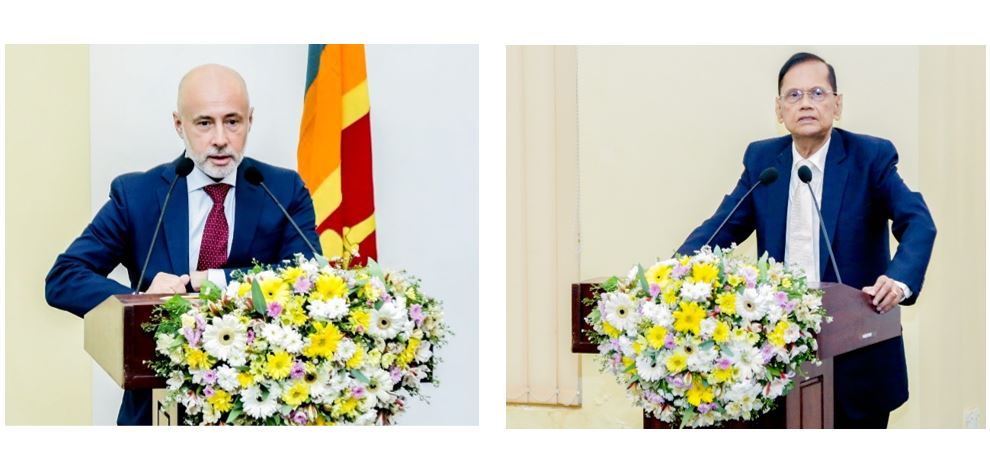

Delivering the keynote address at an expert panel discussion organized by the Centre for Banking Studies under the theme ‘Decoding the National Budget 2024’, he revealed that the recapitalization will not affect the local rupee-denominated markets.

He also added that although the government is able to increase the salaries of state employees in the upcoming year, it is not possible to provide tax relief as Sri Lanka continues to be behind the revenue targets set by the International Monetary Fund (IMF).

According to the budget proposals for 2024, the Ceylon Petroleum Corporation’s debt is valued at Rs. 1 trillion while the Ceylon Electricity Board has an accumulated debt of Rs. 800 billion owed to the state banks.

Due to the debt restructuring process, banks face the risk of recording large losses which will have to be met by capital infusions from taxpayer funds, he added.

In addition to the Rs. 450 billion alloted for recapitalization, it is proposed that 20% of the shares of the two large state-owned banks should be given to strategic investors or the public to improve capital and reduce the burden on taxpayers’ funds, according to the Treasury Secretary.

-adaderana